When we imagine the things one might pay to get rid of, grey hair and weight come to mind. Many of us have accumulated a bit of both over these past few tumultuous months. This week, crude oil was added to the list when the oil contract price fell to minus $40.32 a barrel, becoming negative for the first time in history.

Earlier this year, in the midst of a major slump in the demand for oil brought on by coronavirus, Saudi Arabia and Russia battled a price war which resulted in increased production just as it was needed least. The price of oil crashed as storage facilities filled to hold the over-abundance of supply.

Traders buying oil futures contracts, with no intention of taking delivery of actual barrels, were suddenly caught with an unexpected price plunge. They faced either storing their oil or selling it at a loss. With an unprecedented level of storage utilization, collapse in demand, and overproduction, you can begin to imagine how prices entered negative territory. Traders were willing to pay to keep their contracts from turning into a liability of physical oil.

In this confluence of two industries trading along the same supply chain, one where oil exists in its material form and the other where it exists as a mere financial instrument, we saw a breakdown in information sharing between them. You can imagine that a trader with greater visibility into the availability of oil storage tanks might have made very different decisions regarding their purchase of contracts.

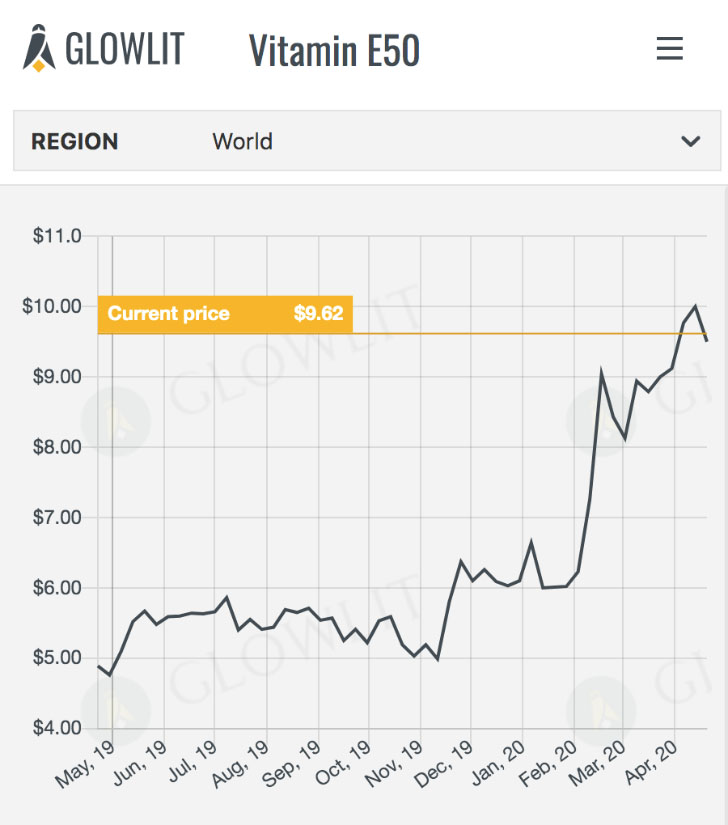

So is Vitamin E50, consumed in large volumes across an array of formulations, at risk of crashing from its coronavirus induced spike? Absolutely yes. Is it at risk of dipping into negative prices once that happens? Probably not. While traders in feed additives do not need to worry about the trading of abstract financial derivatives, the industry does suffer from an information lag across a disjointed supply chain. The price of E50 isn’t likely to go negative, but we can still expect some pretty negative consequences.

Vitamin E50 moves through a supply chain where producers have visibility on the demand of large buyers and traders. Traders in turn, have visibility on the demand in a region they cover where spot purchases are traded within a secondary market. Price volatility in feed additives is the result of an information lag between the top of the supply chain and the bottom. The delay in trade lowers the entire industry’s productivity. When information isn’t evenly and instantly shared across the supply chain, volatility hurts us all.

At Glowlit, we’re here to change that.

(April 27th2020)