With many untapped opportunities remaining in hogs and layers, Myanmar CP Livestock is set to scale up investments in farms, feed and food operations to keep up with growing demand, according to Uthai Tantipimolphan, vice chairman.

Uthai Tantipimolphan

Swine has a promising future due to current low per capita consumption, estimated to be lower than 5 kg/person/year, and a decent profit. The future of the industry is vibrant because of snowballing demand and the growing wealth of Myanmar’s economy.

To catch up with growing consumption, the company has already secured permits to import finishing piglets from Thailand. Half of the piglets are to be reared by the company and the balance by contract growers.

Its immediate goal is to raise a million finishers by 2023 and build a hog slaughterhouse with 30-50 head/hour capacity. Construction of breeder farms with parent stock and grand parent stock units is in the works as well as increased feed mill capacity.

Some 50% of total production is fresh pork that is sold to hotel and food services, 30% to wet markets and 20% supplying the company’s own food operations.

The company has set aside US$200 million for investment from 2018-2023. Some US$40 million will be earmarked for revving up feed capacity, US$10 million for hog farms, a layer complex worth US$12 million, and US$100 million for hog and poultry processing plants.

In 2018 alone, it will spend over US$90 million to raise all around capacity in farm, feed and food operations. Hog farms will be built near Yangon and Mandalay and the layer complex will be established in Mandalay, said Mr Uthai.

Annual turnover in Myanmar will surpass US$1 billion by 2023, up from US$400 million in 2018.

Food and processing operations which currently account for 10% of total revenue will be expanded. Livestock dominates with 50% of turnover and feed 40%.

Annual turnover in Myanmar will surpass US$1 billion by 2023, up from US$400 million in 2018.

Food and processing operations which currently account for 10% of total revenue will be expanded. Livestock dominates with 50% of turnover and feed 40%.

Grooming future leaders

Myanmar CP believes quality is the key to staying ahead of competitors. It has invested substantially in technology and improving employee skills in technical areas, management and leadership in the belief that human resources are the key to sustaining momentum over the long haul.

Key positions such as vice-president, assistant vice-president and production head are now occupied by local employees. Only a few expatriates are still retained to supervise technical operations, he said.

Local employees are more engaged. Mid-to-senior managers undergo training to hone their skills to run the business seamlessly during the transition and become top leaders in the future, Mr Uthai stressed.

Feed

Myanmar CP Livestock is currently operating four feed mills in Yangon, Tongyi, and Mandalay, with total capacity of around 700,000 tonnes/year. Current capacity utilization is around 80%.

The construction of a fth feed mill in Mandalay with 30,000 tonnes/month capacity is about to begin.

Sales of broiler feed account for 55%, layer 30% and the balance a combination of feed for hogs and other species. Of the total sales, 95% is complete feed and 5% concentrate for backyard hog producers.

Compound feed supply in Myanmar is estimated at around 1.5 million tonnes/ year and feed demand is growing by more than 10% per annum.

Food

The company’s ultimate goal is to make progress in the food business and penetrate both modern trade and traditional wet markets. Products must be price competitive because 80% is distributed to wet markets where buyers are price sensitive.

Poultry processing to supply supermarkets, food services and fast food outlets is currently operated by a 3rd party under the company’s supervision. There are four processing plants operating in major markets across the country, with room for more, but bottlenecks must be worked out. It is prepared to invest US$3 million in a processing plant with 5,000 birds/hour capacity to serve fast food clients in 2018.

Plant configuration and hygiene management will be export grade in places where there is the potential to tap into Chinese and Bangladeshi markets in the near future.

Plant configuration and hygiene management will be export grade in places where there is the potential to tap into Chinese and Bangladeshi markets in the near future.

Presently, it supplies markets with 40,000 dressed birds/day. Half is used for fried chicken, ready-to-eat meals and restaurants, while the balance goes to wet markets.

It has earned the right to supply leading quick-serve restaurants due to excellent product hygiene and cutting skills. The birds are reared to live weight of 1.9-2 kg vs a typical 2.4-2.6 kg size available locally. Consistency means that it can supply the correct portions that QSR operators need, said Mr Uthai.

The company oversees two food production plants in Yangon and Mandalay and plans to boost food businesses further. A retail outlet in Yangon selling fresh chicken, pork, eggs, sausages, meatballs, tofu and pre-prepared meals is planned to appraise market preferences.

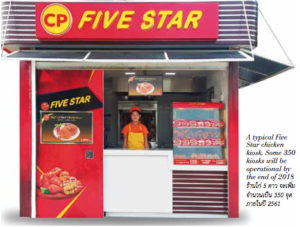

It plans to increase 5-Star roast, fried and grilled chicken kiosks to 350 outlets across Myanmar by the end of 2018.

Mr Uthai is confident that closer integration of the ASEAN economy will facilitate trade, especially in food. This is a big windfall for Charoen Pokphand Foods Plc because the company already operates across all of Southeast Asia.

Farm

For broiler operations, some of the daily supply is produced internally in evaporative cooled housing. However, contract growers make up a sizable share. There

are more than 1,500 small-to-medium contract growers in the broiler sector with the average producer keeping 3,000 birds. The breeds are mainly Ross 308 and Cobb 500.

Layer hens reared in evaporative-cooled housing. Construction of a 500,000-hen layer complex is underway

The company targets supplying two million birds/week for the entire country in 2018, up from 1.7 million birds in 2017. Total market size is three million birds/week.

Construction of breeder farms and hatcheries for broilers and layers is in the pipeline. The first layer complex with 500,000 birds will be built near Yangon and be operable by 2019.

Its core products in Myanmar’s layer sector, currently estimated at 11 million birds, are day-old chicks, pullets and eggs.

It is planning to expand finishing hog production via contract growers. Grand parent stock farms will be built in the near term with a target of one million finishers per year by 2023.

To promote contract growing, it will collaborate with the public sector and financial institutions in providing technical support and financial packages.

The hogs will be reared in evaporative-cooled housing. Each unit will contain four barns equipped with biogas systems holding 2,400 head/site. There will be around 50 villages joining the program.